India’s central bank, the Reserve Bank of India (RBI), is in the process of making its central bank digital currency (CBDC) available without relying on internet access. RBI Governor Shaktikanta Das has emphasized the importance of ensuring the digital rupee’s ease of use. RBI Governor Updates Digital Rupee Progress During an event hosted by the […]

India’s central bank, the Reserve Bank of India (RBI), is in the process of making its central bank digital currency (CBDC) available without relying on internet access. RBI Governor Shaktikanta Das has emphasized the importance of ensuring the digital rupee’s ease of use. RBI Governor Updates Digital Rupee Progress During an event hosted by the […]

Author: Kevin Helms ::: Source link

India Working on Offline Transferability of Digital Rupee, Says Central Bank Governor

SEC Chair Blames Journalists For Asking Him About Crypto So Much

One of crypto’s most powerful government nemeses believes journalists question him about the burgeoning asset class way more than necessary.

Securities and Exchange Commission (SEC) chairman Gary Gensler appeared for a nine-minute interview with CNBC on Wednesday and blamed the host for asking for such an “outsized ratio” of crypto-focused questions.

Gensler Is Tired Of Crypto Questions

Gensler’s interviewer, Andrew Ross Sorkin, suggested that journalists’ focus on the industry may be proportionate to the SEC’s attention to the space. The chairman disagreed.

“No, it’s a function of where your attention is,” Gensler countered. “I’ve been on your show – what a dozen times – and every show you ask about crypto.”

Gensler noted how crypto – which currently boasts a market cap of $2.3 trillion – is just a drop in the bucket next to the $110 trillion capital markets consisting of traditional stocks and bonds.

Relative to its size, he said crypto represents an “outsized piece of the scams, frauds, and problems,” across the market, which may also help explain journalists’ narrow focus on the space.

“My guess is this will be a majority crypto interview, while the capital markets are $110 trillion,” Gensler said. “So it’s also about where the financial media is focused.

Sorkin did indeed ask more about crypto – including whether the SEC views Ether (ETH) as a security, and about the agency’s most recent Wells Notice issued against crypto and stock trading platform Robinhood for alleged securities law violations. Gensler’s answers were indirect as usual, while still insisting that “many” crypto tokens are securities under the law.

The SEC’s Clear Crypto Focus

Over the past 18 months, the SEC has filed several lawsuits and Wells Notices against the biggest crypto companies in the world with ties to the United States.

These include crypto exchanges like Binance, Coinbase, Kraken, and Robinhood, alongside development teams like Uniswap Labs, and stablecoin issuers like Paxos.

In 2023 alone, the SEC brought 43 enforcement actions against digital asset market participants, according to Cornerstone Research. The sheer number of actions has inspired other crypto firms – such as Consensys – to preemptively sue the SEC before being accused of running afoul of what is still a legal grey area.

“We don’t speak about whether somebody is, in our opinion, not following the law unless we actually bring a case,” Gensler stated.

“A lot of people have lost their hard-earned funds in the field that you seem to be so fascinated about,” he added.

Gensler has not refrained from opining on crypto in his capacity – even in his duties as chairman.

Following his agency’s approval of Bitcoin spot ETFs in January, Gensler published an unusual blog post asserting that the agency did still not approve of Bitcoin as an asset. Speaking to CNBC the following day, he also argued that Bitcoin is fundamentally centralized.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Author: Andrew Throuvalas ::: Source link

MoonPay, BitPay partner to simplify crypto transactions

MoonPay, a web3 fintech firm, and BitPay, a crypto payments platform, have teamed up to simplify crypto transactions, aiming to make the process smoother.

MoonPay announced via social media that the partnership would enable easier and faster crypto sales, streamlining how users transfer cryptocurrency to their bank account or debit card.

The integration aims to simplify the digital finance landscape and provide accessible payment solutions, potentially helping crypto users navigate and transact more efficiently.

BitPay expanded its platform in January by supporting a wider range of cryptocurrencies, like Uniswap (UNI), Chainlink (LINK), and BNB. This allowed customers to use digital assets for bill payments and goods purchases.

Earlier this month, MoonPay allowed U.S. customers to buy and sell over 110 cryptocurrencies via PayPal. This integration overcame banking limitations, boosted transaction success rates, and expanded available currencies, including Solana (SOL), Tether, and Dogecoin (DOGE), while protecting users’ personal and card details.

Mastercard partnered with MoonPay in October to explore potential integrations and consumer loyalty opportunities in the emerging web3 ecosystem.

Author: Bralon Hill ::: Source link

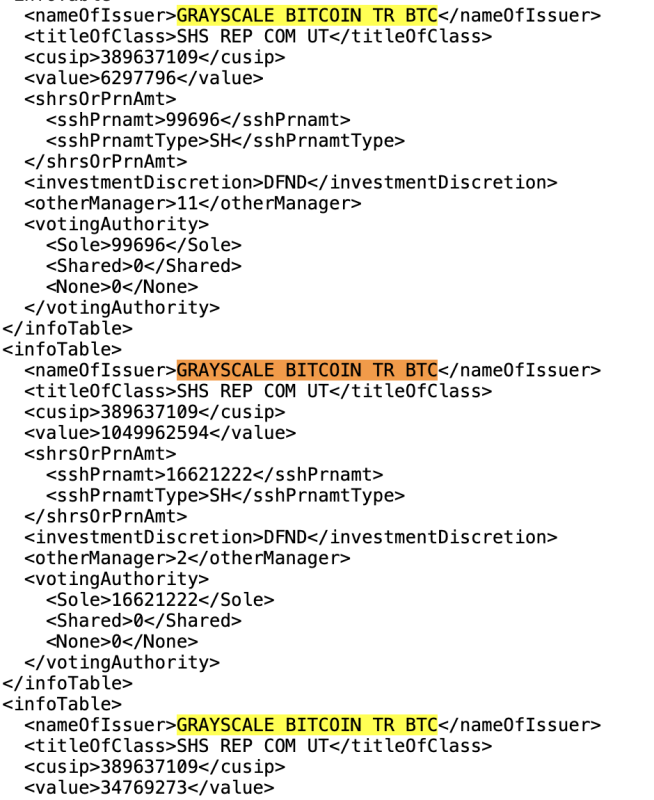

Investment Firm Discloses Over $1.8 Billion in Bitcoin ETF Holdings in SEC Filing

Susquehanna International Group, LLP (SIG), a global trading, technology, and investment firm, disclosed that it holds over $1.8 billion in Bitcoin exchange-traded funds (ETFs) through a 13F-HR filing submitted to the Securities and Exchange Commission (SEC), providing a detailed breakdown of SIG’s investment portfolio.

The filing reveals the investment firms biggest positions were in Grayscales Bitcoin ETF GBTC, totaling $1,091,029,663.

The documents also revealed that SIG holds positions in ARK 21SHARES BITCOIN ETF, BITWISE BITCOIN ETF TR, BITWISE FUNDS TRUST (BITCOIN AND ETHER), FIDELITY WISE ORIGIN BITCOIN, FRANKLIN TEMPLETON DIGITAL BITCOIN ETF, GLOBAL X BITCOIN TREND, INVESCO GALAXY BITCOIN ETF, ISHARES BITCOIN TR, PROSHARES TR SHORT BITCOIN, PROSHARES TR BITCOIN STRATE, PROSHARES TR BITCOIN & ETHER, VALKYRIE BITCOIN FD, VALKYRIE ETF TRUST II BITCOIN AND ETHE, VALKYRIE ETF TRUST II BITCOIN MINERS, VALKYRIE ETF TRUST II BITCOIN FUTR LEV, VANECK BITCOIN TR, VOLATILITY SHS TR 2X BITCOIN STRAT, and WISDOMTREE BITCOIN FD.

The total combined amount of assets across all these ETFs add up to over $1.8 billion at the time of writing.

Interestingly enough, the investment firm noticeably holds $4,037,637 worth of ProShares short bitcoin ETF, which aims to offers investors the potential to profit on days when BTC drops in price. In addition to this, SIG also holds $1,004,552 worth of Valkyrie Bitcoin Futures Leveraged Strategy ETF and $97,856,513 worth of Volatility Shares 2x Bitcoin ETF, to profit even further on days when the price of BTC is rising.

Bitcoin ETFs offer institutions a regulated and accessible way to gain exposure to Bitcoin’s price movements, but gives up the ability for investors to directly hold the bitcoin themselves.

SIG’s disclosure of holding over $1.8 billion in Bitcoin ETFs reflects the growing trend of institutional adoption and investment in Bitcoin as part of a diversified investment strategy. Market researchers and analysts expect more institutions to file these 13F-HR documents with the SEC in the coming months, revealing specifically who has been purchasing spot Bitcoin ETFs since they went live earlier this year in January.

Author: Nik Hoffman ::: Source link

Crypto Industry Flexes Financial Muscle With $100M Super PAC War Chest For 2024 US Elections

A recent report by OpenSecrets.org revealed that cryptocurrency industry Super Political Action Committees (PACs) have accumulated a staggering $102 million war chest to exert their influence on the upcoming 2024 US congressional elections.

The data, compiled by Public Citizen, highlights the sector’s concerted efforts to sway elections in favor of pro-crypto candidates and impede regulatory measures to ensure compliance within the industry.

Crypto Billionaires Lead Funding Surge

Rick Claypool, a research director for Public Citizen and author of the report, emphasized that a fresh wave of crypto corporations, executives, and their allies have returned to the political landscape, pouring millions of dollars into campaigns.

Their objectives reportedly include influencing elections, supporting cryptocurrency-friendly candidates, and obstructing accountability measures to enforce industry regulations.

The report further discloses that over half of the funds raised originate from direct corporate expenditures, primarily attributed to Coinbase and Ripple Labs.

The remaining contributions come from billionaire crypto executives and venture capitalists, including significant sums from the founders of venture capital firm Andreessen Horowitz, the Winklevoss twins, and Coinbase CEO Brian Armstrong.

Of the eight corporate Super PAC donors, four have either settled or faced charges by the US Securities and Exchange Commission (SEC) for alleged violations of securities laws.

According to the report, the largest crypto Super PAC, Fairshake Political Action Committee, has resorted to running political ads that deliberately avoid any mention of cryptocurrencies, employing a “manipulative strategy” to sway voters.

The report also highlights the intervention of crypto Super PACs in primary races for the 2024 elections. Out of the six completed primaries, only one crypto-backed candidate suffered defeat.

However, eleven primary races involving crypto-backed candidates are still ongoing. Moreover, the crypto Super PACs have pledged to allocate funds to Senate races in Ohio and Montana, two crucial battleground states in the general election.

Voters In ‘Swing States’ Demand Reasonable Regulations

A separate study conducted by Digitial Currency Group (DCG), a global investor in blockchain companies, found that more than 20% of registered voters in key “swing states,” or states where support for political parties is divided, consider digital assets an important issue in the 2024 election.

The survey, conducted in partnership with The Harris Poll and encompassing Michigan, Ohio, Montana, Pennsylvania, Nevada, and Arizona, reveals that a pro-crypto stance can be “advantageous” for policymakers and candidates. It emphasizes the desire among voters for “reasonable regulations” that protect consumers without stifling innovation.

Julie Stitzel, Senior Vice President of Policy at DCG, highlighted the poll’s findings, stating that the digital asset industry is at the forefront of swing state voters’ minds and that a positive stance on virtual assets can benefit policymakers and candidates.

Kristin Smith, CEO of the Blockchain Association, echoed this sentiment, emphasizing the growing relevance of digital assets in shaping the electoral landscape in 2024.

Featured image from Shutterstock, chart from TradingView.com

Author: Ronaldo Marquez ::: Source link

AI Tokens ‘Preparing For Round 2’: Industry Shows 8% Growth

Excluding Bitcoin, memecoins were the biggest narrative of this cycle. However, Artificial Intelligence (AI) tokens also performed remarkably during the first quarter of 2024.

The crypto market recovered over the weekend from the May 1st retrace, with AI tokens showing significant gains. As a result, many industry experts think that the sector is poised for a ‘Round 2’ this cycle.

AI Sector Recovers By 8%

Crypto analysts highlighted AI tokens alongside memecoins as the hottest topic of 2024, responsible for most of the massive gains during this cycle.

According to CoinGecko’s report, AI was one of the three sectors that delivered three-digit returns in Q1. Moreover, the largest AI token by market capitalization, Fetch.ai (FET), saw gains of 378.3% during this period.

As a result, some analysts deem the AI sector to be the next main narrative of the cycle. Trader John Walsh, known as CryptoGodJohn, considers “The future of AI coins preparing round 2.”

Walsh added that the AI season is “extremely obvious” and will go “so much higher” based on the developments in the sectors, including Nvidia earnings, Apple AI, and Microsoft’s $100 billion AI fund.

To this, crypto analyst MacroCRG replied that a massive AI growth “will be obvious in hindsight,” considering that the sector’s market capitalization is “just” $27.3 billion.

AI mcap still just $27B

It will be obvious in hindsight https://t.co/HH0Tb86fNY pic.twitter.com/71qgdwdM1C

— CRG (@MacroCRG) May 6, 2024

According to a MacroCRG post, the AI market cap had increased 8% by Monday morning, and its daily trading volume was around $1.9 billion. On Tuesday, the market cap surged to $27.8 billion, a 2.3% increase from 24 hours ago.

In comparison, memecoins $54.4 billion market cap doubles AI’s. However, its market cap decreased by 2.8% in the last day, with the top ten memecoins showing red numbers in the past 24 hours.

Is Artificial Intelligence About To Bloom Or Ruin the World?

Despite the remarkable performance, some figures think the sector has a more pessimistic future. According to memecoin trader Murad, the developments in the industry will “be replacing more & more jobs every year.” As a result, there will be an increase in “Anxieties and desperate attempts to ‘make it.’”

To the trader, the industry will serve as a push for the memecoins sector, as “Growing AI capabilities will be one of the big forces accelerating the Memecoin Bubble.”

Financial giant Warren Buffett shared a more skeptical view on Saturday. The Co-founder and CEO of Berkshire Hathaway revealed he is not sold yet by artificial intelligence. To the CEO:

We let a genie out of the bottle when we developed nuclear weapons. AI is somewhat similar — it’s part way out of the bottle.

Despite this, Buffet recognized the potential for AI technology to change the world positively.

On The Brink Of A Millionaire Boom

“The AI industry is on the brink of a multi-trillion-dollar boom,” stated Alex Wacy. The analyst believes the reasons behind this are the vast and diverse potential of applications.

Moreover, the expert highlights that interest in the sector has steadily increased over the last year. A crypto and AI combination could potentially “create a market valued in the trillions.”

According to the post, the market is projected to reach nearly $2 trillion by 2030, which suggests that the crypto industry should not overlook it.

Tokens like RNDR showed a remarkable performance over the past week, with the price soaring by 45%. RNDR regained the $10 support zone this week after struggling to retest it over the last month.

In the past 24 hours, the token’s price surged 6.4%, and its daily trading volume increased by 16.8%, with over $455 million being traded.

FET is “a top performing AI coin headed into the Nvidia earnings,” as stated by John Walsh. The trader forecast that the token is “looking for a next leg higher up” after successfully retesting the $2.35 resistance level.

$FET break retest now looking for next leg up higher

FET will be a top performing AI coin headed into the nvidia earnings pic.twitter.com/Agl0eqB9mD

— Johnny (@CryptoGodJohn) May 6, 2024

FET broke above this level over the weekend, rising to $2.5 on Monday and remaining above the $2.40 support zone since.

At writing time, the token is trading at $2.42, representing a 2.4% increase in the last 24 hours and a $22.9% surge in the past week.

FET's performance in the weekly chart. Source: FETUSDT on TradingView

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Author: Rubmar Garcia ::: Source link

The Biggest Movers in the RWA Sector in Q1

The previous quarter saw the RWA market grow by leaps and bounds. Tokenized Treasury bills including BlackRock’s USD Institutional Digital Liquidity Fund, Superstate’s Short Duration US Government Securities Fund, and Ondo’s USDY grew by an impressive 41% to nearly $1.3 billion, driven by significant institutional interest and innovative product launches. Let’s recap the key developments and trends in the sector.

Author: Ryan Rodenbaugh ::: Source link

Nigerian banks will start deducting 0.5% cybersecurity levy as directed by CBN

The Central Bank of Nigeria (CBN) has directed banks and other financial entities to impose a cybersecurity charge, on electronic transactions. The communication about this directive was conveyed through a statement signed by two CBN directors, Chibuzor Efobi and Haruna Mustafa.

The objective is to contribute to the National Cybersecurity Fund (NCF) managed by the Office of the National Security Adviser (ONSA).

This introduction of the charge follows the enactment of the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024. According to Section 44 (2) (a) of the Act, a fee of 0.5% will be levied on all transactions carried out by businesses listed in the Second Schedule of the Act. Financial institutions handling these transactions will deduct this fee at the initiation point of transfers. Then transfer it.

Customers will notice this deducted amount labelled as “Cybersecurity Levy” on their account statements. The circular stipulates that deductions should start within two weeks from its issuance date, for all institutions. These collected fees will be sent collectively to the NCF account at CBN by every business day of each month.

The Central Bank of Nigeria has also set out consequences for not following this directive. If a business fails to pay the levy it is seen as breaking the rules. If found guilty may be fined two per cent of its yearly revenue along, with other potential punishments.

This new cybersecurity fee is introduced as banks announce the return of a 2 per cent fee on deposits of over N500,000.

Author: Editorial staff ::: Source link

Cartier Family Member Indicted for Using USDT to Launder Hundreds of Millions in Drug Trafficking Money

Maximilien De Hoop Cartier, a descendant of the family famous for their French luxury goods Cartier, has been indicted for his participation in a network that allegedly used several shell companies to launder drug trafficking money proceeds using USDT. Cartier and five Colombian individuals allegedly conspired to directly launder $14.5 million and used these shell […]

Maximilien De Hoop Cartier, a descendant of the family famous for their French luxury goods Cartier, has been indicted for his participation in a network that allegedly used several shell companies to launder drug trafficking money proceeds using USDT. Cartier and five Colombian individuals allegedly conspired to directly launder $14.5 million and used these shell […]

Author: Sergio Goschenko ::: Source link