Eddy Lazzarin, CTO of A16z Crypto, one of the largest cryptocurrency-focused venture capital funds, has criticized the meme coins’ effect on the broad appreciation of the cryptocurrency market. Lazzarin stated that meme coins undermined the “long-term vision of crypto” that has maintained some actors in the space, making it look “like a risky casino.” A16z […]

Eddy Lazzarin, CTO of A16z Crypto, one of the largest cryptocurrency-focused venture capital funds, has criticized the meme coins’ effect on the broad appreciation of the cryptocurrency market. Lazzarin stated that meme coins undermined the “long-term vision of crypto” that has maintained some actors in the space, making it look “like a risky casino.” A16z […]

Author: Sergio Goschenko ::: Source link

A16z Exec Blasts Meme Coins: They Make Crypto Look ‘Like a Risky Casino’

Trader Made $23M Flipping Solana Meme Coins: Details

A meme coin trader has reportedly cashed out over $22 million in profits from multiple positions in meme-themed tokens on the Solana blockchain.

According to blockchain analysis firm Lookonchain, the actions of a trader identified as “paulo.sol” on the Solana Name Service account were flagged on April 26.

Meme Coin Trader Profits Over $22 Million

The meme coin trader achieved profitable outcomes from assets like Dogwifhat (WIF), Jeo Boden (BODEN), and Bonk (BONK).

They initiated their investment in BONK as early as November 11, 2023, after observing its upward trajectory. Employing a strategy of purchasing during downturns and selling during peaks, they executed swing trades, resulting in an accumulation of approximately $6.28 million in profits from trading BONK.

What a legend!😱

paulo.sol has realized profits of $9.51M on $WIF, $7.04M on $boden and $6.28M on $BONK.

1/ Let’s dig into his trades to see what he’s buying.👇 pic.twitter.com/2axUwHb3el

— Lookonchain (@lookonchain) April 26, 2024

Recognizing the potential in WIF and BODEN, the trader didn’t enter these tokens at launch but started accumulating them during upward movements. They purchased WIF on December 4, 2023, and initiated BODEN trades on March 6. As a result, the trader realized profits of $9.51 million from WIF trades and $7.04 million from BODEN transactions.

They got approximately $22.83 million from flipping Solana-based meme tokens. While significant profits have already been secured, the trader currently has $7.6 million in BODEN tokens and $5.7 million in WIF.

Furthermore, the trader expanded their meme coin portfolio by investing in additional tokens. They allocated $1.77 million to POPCAT and nearly $6 million to PUPS, subsequently becoming the largest holder of PUPS on the Solana blockchain.

Traders Capitalize on Solana Meme Coin Frenzy

Community members have applauded the trader for the impressive moves in the crypto market. One user noted that the trader’s success was not merely luck but rather a demonstration of their unwavering belief compared to others.

Another user commended the trader for exhibiting “diamond” hands, a term used to describe traders who can maintain their positions even in challenging market conditions.

The trader is among many who have profited from the Solana meme coin frenzy. On April 3, another trader turned $13,000 into $2 million within one hour. In this case, they purchased 499.9 million MOEW using 4 Ether just 10 minutes after MOEW was listed on decentralized exchanges (DEXs). Less than an hour later, they sold 111.65 million MOEW for 99 ETH ($328,000) and were left with 388.24 million MOEW.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Author: Wayne Jones ::: Source link

Bitcoin Runes attract $135m in fees post-halving

Nearly a week after the halving, Bitcoin Runes have achieved a milestone as observers and participants alike deliberate over the impacts of the new standard.

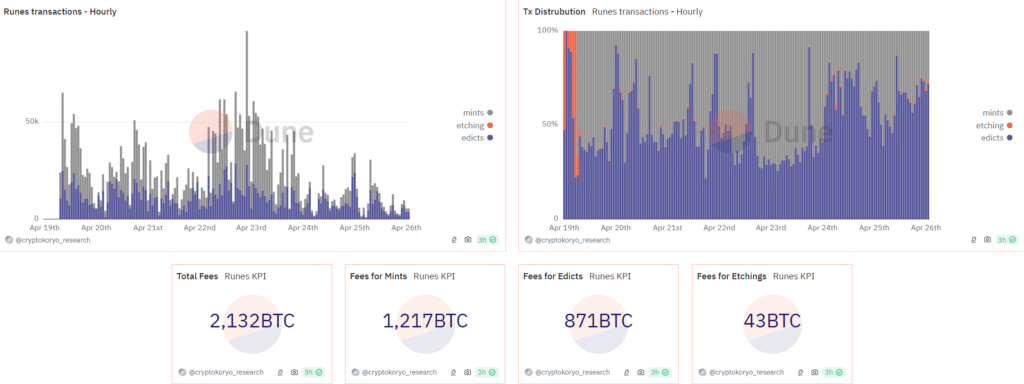

According to a Dune Analytics dashboard, the Runes protocol on Bitcoin (BTC) has raked in $135 million in transaction fees on the cryptocurrency’s largest blockchain. On-chain data showed that tokens issued under the standard generated more than 2,100 BTC costs within a week.

Casey Rodarmor, the same mind behind the Ordinals protocol, developed Bitcoin Runes to improve the BRC-20 standard, which is touted to bootstrap defi on BTC’s network.

Runes allows users to execute more efficient transactions and mint better-optimized tokens on BTC by tapping BTC’s UTXO format. The concept launched during the halving and has become a source of on-chain BTC activity ever since.

Per Bitcoin Wallet Unisat, users have minted nearly 11,000 Runes, a flurry of blockchain participation that skyrocketed BTC gas fees shortly after the halving. However, fees have retraced in the days after Bitcoin’s quadrennial code switch, which cut block mining rewards by 50%.

Analysts: Bitcoin Runes may benefit network long-term

Shipped at a block height of 840,000, Bitcoin Runes initially caused a surge in BTC transaction costs, but analysts do not expect this effect to remain in the long run. Bitcoin researcher Jade ARdinals shared with crypto.news that the additional load on BTC’s network was only caused by the token creation aspect, otherwise known as minting.

The researcher explained that speculation around Runes triggered mass minting, adding an “artificial” burden on BTC block space. Analysts believe this pressure will subside but maintain that the Runes standard will attract more developers to Bitcoin.

“Speaking broadly, the adoption of Runes has a generally positive long-term impact on the network, and the hype around their minting through airdrops will fade as the most sought-after tokens launched during the halving are minted out.”

Jade ARdinals on Runes

Runes have already captured a chunk of BTC’s on-chain activity. Crypto Koryo’s Dune dashboard reported that Runes tokens accounted for 45% of all Bitcoin transactions on April 25.

Author: Naga Avan-Nomayo ::: Source link

Top 10 Tips for Every Bitcoin Multisig Beginner

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

As technical director on the Concierge team at Unchained, I’ve fielded countless client questions about bitcoin multisig. If you’re just beginning to understand the benefits of multisig and how it works in a collaborative custody context, I hope these ten tips will address some of your questions.

Bitcoin doesn’t live on your device

The phrase hardware wallet might make it seem like your bitcoin live inside the wallet itself, but that’s not the case—bitcoin is never in your device at all. In actuality, your wallet generates and stores your keys only. Your wallet also makes accessing the keys user-friendly by either plugging your device into a general-purpose computer or sharing information with your computer via a microSD card.

So where does bitcoin live, then? The bitcoin blockchain is a ledger that keeps track of every transaction that has ever occurred and the balances of every address on the network. Instead of storing your bitcoin, your hardware wallet protects and stores the keys used to unlock—or spend—bitcoin from those addresses.

You can restore your seed phrase to another hardware wallet

When you set up a bitcoin hardware wallet that respects best current practices, you should be prompted to back up your wallet using 12 or 24 words, typically on a slip of paper that the manufacturer suggests you protect in case something happens to your wallet. These 12 or 24 words are your seed phrase, as established in Bitcoin Improvement Proposal 39, or BIP39.

Your seed phrase is like the “key to the castle,” it contains everything you need to recover and use a key to all of the addresses protected by the seed phrase.

The nice thing about BIP39 seed phrases is that they are interoperable among hardware wallets that support the standard, which means you can recover your bitcoin wallet backup (seed phrase) to another brand of hardware wallet. If you initially set up your bitcoin wallet on a Trezor and want to move to a Coldcard, it’s as simple as importing those 12 or 24 words.

Read more: How to replace or upgrade a bitcoin hardware wallet

You don’t need your hardware wallet with you to receive

With physical cash, you have to be physically present to trustlessly and securely transact with another party. Bitcoin fixes this for the digital world. If you want to receive bitcoin but don’t have your hardware wallet at hand, you can still have a payment sent to the appropriate address.

As mentioned above, bitcoin does not live on your hardware wallet; it lives on the bitcoin blockchain. For that reason, as long as you or someone else sends bitcoin to an address that you hold the private keys to control, you’ll always be able to move those funds regardless of whether you have physical access to your device. If bitcoin is sent to an address you know you control, it will arrive perfectly fine in the background without your involvement.

What this means for you: If you create a multisig wallet and store your hardware wallets or seed phrases in secure locations, you don’t need to have physical access to them to deposit funds.

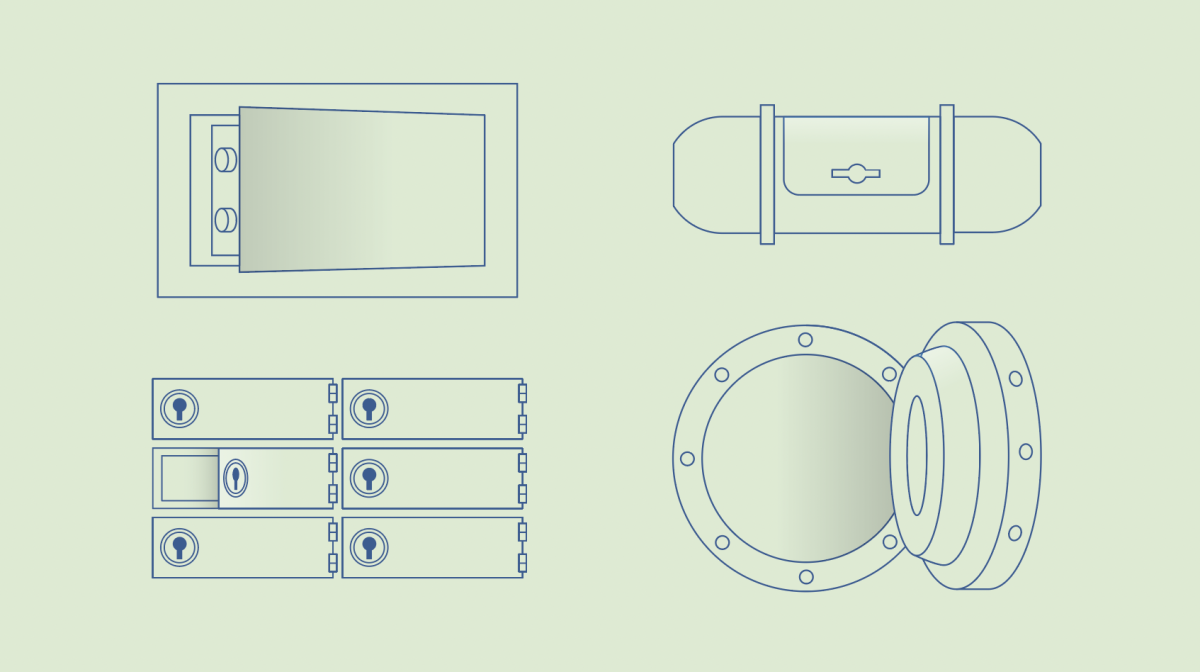

A device used as a key in multisig can still be used as a singlesig wallet

Multisig involves constructing a multisig wallet using the public keys of multiple devices, each of which could also serve as a standalone singlesig wallet without any issues. When you create a multisig wallet following the emerging standard processes, the preexisting singlesig counterparts have no idea the multisig wallet exists.

You could think of it as a group email address that forwards to multiple individual email addresses.

This means that, if you wanted, you could store smaller amounts of bitcoin on a singlesig wallet—all while keeping your primary wealth in a multisig wallet constructed using that device as one of the keys.

Confirm your multisig deposit address

Bitcoin transactions are completely irreversible, which means if you send your bitcoin to the wrong address, it can be lost permanently. Thankfully, you can use hardware wallets to check your multisig bitcoin address on the device before sending funds.

Checking your address on your device confirms three things:

- that the address was built correctly (i.e. that it’s 2-of-3 multisig, for example, and not 2-of-5 where an attacker has added two keys and actually controls the funds)

- that the computer you’re working on isn’t compromised with malware that finds and replaces bitcoin addresses with an attacker’s address, and

- that your device holds a key to the address.

Checking the address on your device should be done before sending meaningful amounts of funds to any address, whether singlesig or multisig. As of this writing, Trezor and Coldcard support checking multisig deposit addresses in the Unchained platform.

Read more: How do I verify the receiving/deposit address on my hardware wallet?

You don’t need your devices physically together to sign

With multisig, you don’t need to have all your keys in the same place at the same time to spend bitcoin. That means you can sign a transaction in Austin with one key and sign a day later in Dallas with the other. The transaction can only be broadcast after all the necessary signatures have been collected (two in a 2-of-3 multisig scheme, for example).

This is a significant advantage over other bitcoin custody models like Shamir’s Secret Sharing Scheme, which allows you to distribute control over your bitcoin private key by splitting it into multiple parts (secrets), but requires all parts to be present at the same time to recompile a single key and author a transaction.

You can make a mistake in multisig and still recover your funds

In all bitcoin multisig setups where m (the number of keys required to sign) is less than n (the total number of keys in the quorum), you are protected from single points of failure and can still recover your funds in the case that one or more critical items are lost, stolen or otherwise compromised.

There are scenarios in 2-of-3 multisig (with a collaborative custody partner like Unchained holding the third key), where as many as three items could be compromised before it becomes impossible to recover your funds.

Even though fault-tolerance in multisig provides peace of mind, all of these scenarios should still be protected against at all costs by following seed phrase and hardware wallet storage best practices, and you should always regain full control as soon as possible in the event that any of your critical items are lost or compromised. And that leads us to number eight…

Read more: The ultimate guide to storing your bitcoin seed phrase backups

You can replace a key in your multisig setup if needed

When using bitcoin multisig, if you ever lose a wallet or misplace a seed phrase, it’s important to replace this key in your multisig m-of-n scheme. You can do this with any of the popular multisig wallets.

Even if a single compromised key does not alone jeopardize your funds in most common multisig m-of-n schemes, replacing a compromised key will ensure that you regain complete control over your funds and eliminate the possibility that the key could ever be used against you in the future.

In a collaborative custody model like the one we use here at Unchained, replacing a key is straightforward. You can simply log in to our platform, choose the key that has been compromised, and quickly replace it with a new one. You can read the full process for replacing or upgrading a hardware wallet at the link below, and if you’re already an Unchained client, check out our Knowledge Base article.

Read more: How to replace or upgrade a bitcoin hardware wallet

You can construct multiple multisig wallets using the same devices

As we mentioned in number four on this list, using your hardware wallets/seed phrases for both a singlesig wallet and to construct a multisig wallet doesn’t cause any issues. Similarly, using your hardware wallets/seed phrases for more than one multisig wallet doesn’t cause a conflict among those wallets as long as you aren’t using the same extended public keys (xpubs). This is typically represented as a multiple accounts feature in most bitcoin wallets.

Hardware wallets allow you to use different xpubs from different derivation paths, which is a technical way of saying a different set of bitcoin keys on your hardware wallet generated by the same 12- or 24-word seed phrase. This means you can create multiple multisig wallets that stem from the same set of seed phrases/devices, like using the same devices for a personal vault and an IRA vault. Maybe even a loan vault as well!

Collaborative custody doesn’t introduce a single point of failure

When getting started with multisig collaborative custody at Unchained, one concern I hear a lot relates to dependence on our platform. If Unchained were to cease to exist or have significant downtime, how would you recover your funds if your wallets were constructed using our tools?

Our multisig platform is designed to eliminate all single points of failure, and that includes ourselves. As our platform is fully interoperable with established bitcoin standards, you can always recover access to your vault outside the Unchained platform with compatible software like our open-source multisig coordinator, Caravan, or bitcoin wallets like Sparrow or Electrum. Just make sure to safely back up your wallet configuration file!

Read more: How can I recover my vault funds using Caravan?

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Author: Unchained ::: Source link

New Data Reveals Bitcoin Mining May No Longer Be Profitable

New data has revealed that Bitcoin (BTC) mining might no longer be as lucrative as it used to be. Bloomberg has reported that the profitability of Bitcoin mining is nearing a record low, not seen since the days following the collapse of FTX, posing significant challenges for those securing the network.

The data indicates that the “hashprice,” a metric that gauges the revenue a miner earns daily for each petahash of computing power, has dipped alarmingly close to its all-time low.

This decrease is notable, considering it came after the recent Bitcoin halving event on April 20, which traditionally boosted the cryptocurrency’s value but, this time, failed to counteract the bearish pressures from global economic uncertainties.

Notably, the term “hashprice,” coined by Luxor Technologies, reflects the ‘harsh’ realities facing miners post-Halving. The event, which occurs every four years, reduces the block reward for miners by half, intending to maintain a deflationary schedule for Bitcoin’s issuance.

Understanding Bitcoin Hashprice Dynamics

On April 20, immediately following the halving, the BItocin hash price spiked to $139, but this was short-lived. The surge was primarily due to increased transaction fees related to the Rune protocol activities on Bitcoin’s blockchain.

However, as these fees normalized and mining difficulty increased, hashprice values plummeted to $57, perilously close to the November 2022 low of $55. This value represents miners’ stark decline in profitability, forcing them to depend more on transaction fees and the potential appreciation in Bitcoin’s price.

Reducing mining profitability also signals tough times ahead, particularly for smaller mining operations.

According to Bloomberg, larger mining companies like Marathon Digital Holdings Inc. and Riot Platforms Inc. have proactively invested in extensive mining infrastructure and advanced equipment to withstand the profitability crunch.

Conversely, smaller entities might struggle to remain viable in an industry that is becoming increasingly competitive and capital-intensive.

Marathon Digital’s Strategic Expansion

In response to the challenging environment, Marathon Digital has raised its hash rate growth target for 2024, aiming to adapt to the new mining reward baseline of 3.125 BTC post-halving.

The company started the year with a hash rate capacity of 24.7 exahash per second and planned a 46% increase. Following strategic acquisitions and increased equipment orders, Marathon anticipates reaching a hash rate of 50 EH/s by year’s end.

Fred Thiel, Marathon’s Chairman and CEO, expressed confidence in meeting these growth targets without additional capital infusion, citing the firm’s solid liquidity position. Thiel noted:

Given the amount of capacity we have available following our recent acquisitions and the amount of hash rate we have access to through current machine orders and options, we now believe it is possible for us to double the scale of Marathon’s mining operations in 2024 and achieve 50 exahash by the end of the year.

The company’s advancements in mining technology and efficiency also aim to reach an operational efficiency of 21 joules per terahash, further solidifying its foothold as a leader in the sector.

Featured image from Unsplash, Chart from TradingView

Author: Samuel Edyme ::: Source link

It’s Time To Swap Your Dollars For Bitcoin

Billionaire investor Anthony Scaramucci, the founder of SkyBridge Capital, recently discussed the viability of financial assets. He took to X, a social media platform previously known as Twitter and owned by Elon Musk, to highlight the decreasing purchasing power of the United States dollar in comparison to the potential of Bitcoin (BTC).

US Dollar Vs. Bitcoin Value Performance

In the post on X, the SkyBridge Capital founder pointed out that a dollar from 2020 is now only worth about 75 cents, underscoring a significant devaluation due to inflation.

According to Scaramucci, this scenario illustrates why investors should reconsider traditional fiat currencies as a reliable store of value, advocating instead for the inherent benefits of digital assets like Bitcoin.

Dollar from 2020 is now worth 75 cents. Buy Bitcoin credit @balajis pic.twitter.com/WzIosKfJv2

— Anthony Scaramucci (@Scaramucci) April 26, 2024

Scaramucci’s critique comes at a time when the global economy grapples with heightened inflation rates, which have eroded the real value of fiat money.

He specifically cited a “25.14% compounded inflation rate” as a critical indicator of why the dollar is losing ground. In contrast, Bitcoin has not only maintained a strong profile but has also appreciated in value, further cementing its position as a viable hedge against inflation and a potential safe haven for investors.

So far, Bitcoin’s market performance has been quite appealing. Particularly, despite the significant downturn experienced in the past few years, the asset has managed to come out of the bloodbath and recently soared to an all-time high above $73,000 in March.

This peak performance labels Bitcoin as not just a digital asset but a major player in the global financial landscape.

However, despite Scaramucci’s bullish outlook, it’s worth noting that Bitcoin has seen its share of volatility. It has been struggling to maintain its appeal recently, with a modest 0.9% increase in the last 24 hours – a slight recovery from a 2% drop over the past week.

BTC Shifting Market Sentiments

Further insights into the market’s behavior towards Bitcoin reveal changing dynamics. Data from CryptoQuant highlighted a negative turn in the Bitcoin funding rate for the first time since October 2023, indicating a cooling interest in speculative trading on the asset.

This shift suggests that while the long-term outlook might still be strong, short-term investor sentiment has become cautious, possibly awaiting clearer signals before making further commitments.

The current market sentiment is also reflected in the technical analysis of a prominent crypto analyst, Ali. In Ali’s recent post on X, a notable mention was made of a “death cross” seen in Bitcoin’s 12-hour chart, where the short-term moving average dips below a long-term counterpart, traditionally a bearish signal.

Additionally, the Tom Demark (TD) Sequential indicator points to potential price reversals after a consistent trend, adding another layer of complexity to Bitcoin’s trading strategy.

Despite these potentially bearish indicators, on-chain data from Santiment shows an interesting trend: Bitcoin whales have increased their holdings significantly, now owning 25.16% of the total supply.

This accumulation suggests that while retail sentiment may be bearish, large-scale investors are seeing the dips as buying opportunities, potentially prepping for a future bullish run.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Author: Samuel Edyme ::: Source link

Bitcoin Chops Around $64K, With Japanese Yen’s Tumble Maybe Signaling ‘Currency Turmoil,’ Analyst Says

The yen’s devaluation didn’t impact crypto markets yet, but this could change if the BOJ steps in to prop up the currency, Noelle Acheson, analyst and author of the Crypto Is Macro Now reports, said in an email interview. A possible intervention would mean the BOJ selling U.S. dollar assets (U.S. Treasuries) to buy yen, and a weaker greenback could in theory help crypto prices, she added.

Author: Krisztian Sandor ::: Source link

Bitcoin Conference to Bring Star-Studded Lineup of Speakers to Hong Kong on Dawn of Historic ETFs

PRESS RELEASE. Excitement is brewing in the heart of Asia as Hong Kong regulators pave the way for a new era of innovation with the recent approval of spot Bitcoin exchange-traded funds (ETFs). This groundbreaking development underscores Hong Kong’s commitment to becoming a regulated hub for Bitcoin. At the same time, the Bitcoin Conference is […]

PRESS RELEASE. Excitement is brewing in the heart of Asia as Hong Kong regulators pave the way for a new era of innovation with the recent approval of spot Bitcoin exchange-traded funds (ETFs). This groundbreaking development underscores Hong Kong’s commitment to becoming a regulated hub for Bitcoin. At the same time, the Bitcoin Conference is […]

Author: Media ::: Source link

Pantera Capital’s Fund V Targets $1 Billion for Diverse Blockchain Investments

Pantera Capital is seeking to secure $1 billion for its new fund, ‘The Panter Fund V. ‘ It is designed to provide investors with exposure to a wide range of blockchain-based assets.

A new report by Bloomberg revealed that the new fund is expected to launch in April 2025.

Pantera Fund V

The Pantera Fund V has been designed to be an all-encompassing product, differing from the digital asset investment manager’s previous funds with more specific investment focuses such as the Liquid Token Fund, Early Stage Token Fund, Bitcoin Fund, and Venture Funds. Qualified investors must allocate a minimum of $1 million, with the first close scheduled for April 1, 2025.

Limited partners are expected to contribute a minimum of $25 million to participate in the fund.

Its website states,

“Fund V offers exposure to the full spectrum of blockchain assets. The venture-style Fund will invest in venture equity, early-stage tokens, and liquid tokens.”

The fund, if successful, would become the largest raised since the sector’s collapse amidst scandals and bankruptcies in 2022, according to the report. The fund managers encountered significant difficulties in raising new capital last year, but this appears to be changing as the sentiment of key players improves.

With the market recovery, Pantera’s new fund is expected to match the size of its last one, which raised about $1.25 billion two years ago.

Pantera Capital Scores Discounted Solana Tokens

In addition to the new fund, Pantera Capital also emerged as one of the successful bidders for another batch of discounted Solana tokens. They were auctioned by the administrators overseeing the bankruptcy of the now-defunct FTX cryptocurrency exchange.

Approximately 2,000 SOL tokens were sold this week, though this information hasn’t been publicly disclosed. Neither Pantera nor the FTX estate spokespeople have commented on the sale yet. Earlier this month, the FTX estate disposed nearly two-thirds of a $2.6 billion stash of Solana tokens at a discounted rate, attracting interest from Pantera and Galaxy Digital, as reported by insiders.

The 41 million SOL tokens being sold are locked under a pre-agreed vesting period spanning four years. Despite previous auctions fetching roughly $60 per token, sources reveal that these recent coins were sold at a higher price. More auctions are expected to follow.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Author: Chayanika Deka ::: Source link